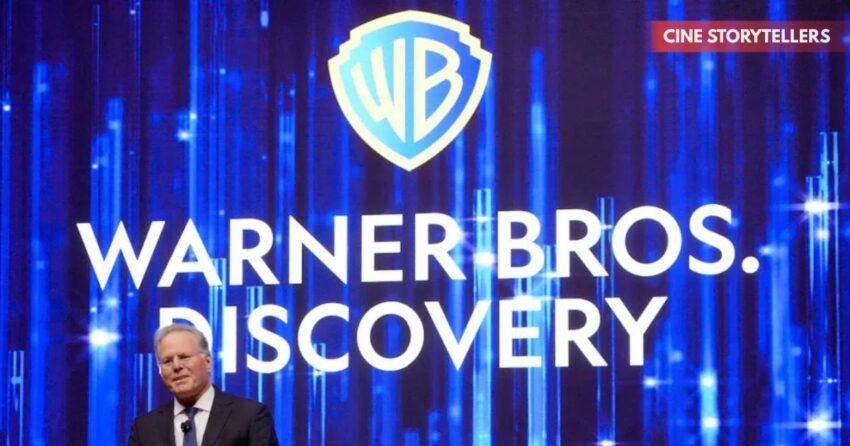

Warner Bros. Discovery is standing at a crossroads that could permanently alter the entertainment industry. With competing acquisition interest from Netflix and Paramount Skydance, the company’s future – and that of Hollywood’s traditional studio model – hangs in the balance. At the center of it all is CEO David Zaslav, whose long-term compensation and stock holdings could make him a billionaire if a deal is finalized. This isn’t just a corporate transaction; it’s a moment that highlights the clash between old-school studios and modern streaming empires. In this deep dive, we break down the situation in clear, conversational terms — what’s driving the sale, why multiple bidders are circling, and how the outcome could change the way movies and TV shows are made and watched.

Why Warner Bros. Discovery Is Considering a Sale

Warner Bros. Discovery didn’t arrive at this moment overnight. The company was formed through a massive merger that promised scale, efficiency, and global reach — but the reality has been far more complicated.

Like many legacy media companies, Warner Bros. Discovery has been navigating:

- Declining cable TV revenue

- Rising streaming costs

- Increased competition from tech-driven platforms

- Pressure from investors demanding clearer growth paths

Despite owning some of the most recognizable entertainment brands in the world — including Warner Bros. studios, HBO, and Discovery — the company has struggled to convince Wall Street that its current structure is the best long-term solution.

Selling all or part of the business has become a way to unlock value quickly while passing future risk to a larger, better-capitalized owner.

The Two Very Different Bidders: Netflix vs Paramount Skydance

What makes this situation especially fascinating is that the two interested parties represent two opposing visions of entertainment’s future.

Netflix’s Strategy: Content Control at Scale

Netflix isn’t just interested in buying another studio — it wants control. Owning Warner Bros.’ film and TV production arms would give Netflix direct access to:

- A century-old movie studio

- One of the deepest scripted TV libraries ever assembled

- Globally recognized franchises with built-in audiences

For Netflix, this move would reduce dependence on external licensing deals and allow it to fully control how content is produced, released, and monetized — all within its own ecosystem.

This approach reflects Netflix’s belief that the future belongs to platforms that own both distribution and creation.

Paramount Skydance’s Approach: A Traditional Power Play

Paramount Skydance’s interest signals something different. Rather than carving out pieces of Warner Bros. Discovery, this bid reflects a desire to absorb the company more completely.

This strategy suggests confidence in the traditional studio model — theatrical releases, linear TV, streaming, and global distribution all working together under one corporate roof.

For shareholders, the appeal is straightforward: a larger offer and simpler structure, even if it comes with its own operational challenges.

David Zaslav’s Role in This Pivotal Moment

David Zaslav didn’t inherit an easy job. Since taking the helm, he has overseen:

- Aggressive cost-cutting

- Content restructuring

- Layoffs and reorganization

- A shift in streaming priorities

These moves made him a controversial figure among creatives but a respected operator among investors focused on financial discipline.

What makes this moment especially notable is that Zaslav’s compensation structure ties his personal wealth directly to the company’s valuation. If a sale happens at current estimates:

- His stock awards dramatically increase in value

- Long-term incentives trigger payouts

- His net worth could cross the billion-dollar threshold

It’s a rare case where corporate strategy, personal fortune, and industry transformation collide at once.

Why This Isn’t Just About One Executive’s Payday

It would be easy to reduce this story to executive wealth — but that misses the larger implications.

This sale could:

- Redefine how studios operate

- Shift power away from traditional Hollywood gatekeepers

- Accelerate streaming consolidation

- Change how films reach theaters (or skip them entirely)

For decades, Warner Bros. helped shape cinematic history. Whoever controls it next will influence what kind of stories get told — and how audiences experience them.

What Happens to Warner Bros.’ Legendary Brands?

One of the biggest questions surrounding any sale is the fate of Warner Bros.’ iconic properties.

These aren’t just assets — they’re cultural touchstones:

- Long-running film franchises

- Award-winning TV series

- Generations of storytelling history

Under a streaming-first owner, these brands could see:

- Faster production cycles

- Platform-exclusive releases

- Global rollout strategies over regional ones

Under a traditional media owner, the focus might remain on theatrical prestige, broadcast partnerships, and staggered releases.

The buyer’s philosophy will shape these properties for years to come.

Also Read : Ella McCay Movie Review: Emma Mackey Delivers in James L. Brooks’ Heartfelt

The Regulatory Hurdle No One Can Ignore

Deals of this size don’t happen quietly — and they don’t happen quickly.

Any acquisition involving a company as influential as Warner Bros. Discovery will attract scrutiny from:

- Antitrust regulators

- Lawmakers

- Industry watchdogs

Concerns typically center on:

- Reduced competition

- Market dominance

- Consumer choice

- Pricing power

Even if both parties are eager to close a deal, regulatory approval could take months — or longer — and there’s no guarantee it will be granted without conditions.

How Employees and Creators Are Likely to Be Affected

Behind every corporate transaction are thousands of people whose futures hang in the balance.

A sale often leads to:

- Organizational overlap

- Department consolidation

- Job uncertainty

For writers, directors, and producers, ownership changes can affect:

- Creative freedom

- Budget approvals

- Green-lighting decisions

While executives focus on valuations, the creative workforce often feels the most immediate impact — and that uncertainty is already being felt across the industry.

What This Means for Viewers at Home

This deal won’t just affect boardrooms — it could change how audiences consume entertainment.

Potential outcomes include:

- Fewer platforms with more exclusive content

- Shifts in subscription pricing

- Changes in theatrical vs streaming release windows

- Greater emphasis on global appeal over niche storytelling

For viewers, consolidation can bring convenience — but it can also limit choice.

Why This Sale Signals a Bigger Industry Shift

At its core, this moment reflects a larger truth: the entertainment industry is still searching for its final form in the streaming era.

Studios are no longer just creative hubs — they’re pieces on a financial chessboard. Streaming companies aren’t just distributors — they’re becoming cultural institutions.

The Warner Bros. Discovery sale represents:

- The end of one era

- The uncertainty of the next

- A reminder that even legacy giants must evolve or be absorbed

What Happens Next?

In the coming months, expect:

- Continued negotiations

- Potential bid revisions

- Regulatory discussions

- Shareholder pressure

The outcome may not be decided quickly — but when it is, it will ripple across Hollywood and beyond.

Whether Warner Bros. Discovery becomes part of a streaming empire or strengthens a traditional studio rival, one thing is clear: this decision will define entertainment’s next decade.

Also Read : Cardi B Claps Back at JD Vance: A Bold Move That Shook Social Media

FAQs

Why is Warner Bros. Discovery considering a sale now?

The company faces financial pressure, industry disruption, and investor demand for clearer growth strategies. A sale offers a faster path to unlocking value.

Who are the main interested buyers?

Netflix and Paramount Skydance represent two competing visions — a streaming-first future versus a traditional studio-centric model.

Why could David Zaslav become a billionaire?

His compensation includes stock and performance incentives that could dramatically increase in value if a major sale closes.

Will this affect HBO and Warner Bros. movies?

Yes. Ownership changes can influence production priorities, release strategies, and creative direction.

How long could this process take?

Large media acquisitions often take a year or more due to negotiations, shareholder approval, and regulatory review.

Join our WhatsApp channel for more updates and information about celebrities and entertainment.

I’m Atul Kumar, founder of Cine Storytellers and an entertainment creator with 5+ years of experience. I cover films, celebrities, music, and OTT content with a focus on accurate, ethical, and engaging storytelling. My goal is to bring readers trustworthy entertainment news that informs, inspires, and goes beyond gossip.

Discover more from Cine Storytellers

Subscribe to get the latest posts sent to your email.